Asset Allocation Software |

The ALM OptimizerProduct Features |

The software will facilitate your solutions to the following topics and questions.Portfolio Optimization ModuleAlpha Effects

Allocation Weights Sensitivity

Equivalent Risk or Return Portfolios

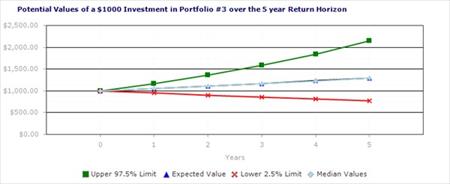

Forward Looking Confidence Regions

Institutional Restrictions

Liability Driven Investment Decisions

Rebalancing Problems

Risk Driven Investment Decisions

Factor Asset Re-allocation

Return on Risk Allocations

Inputs |

|

|

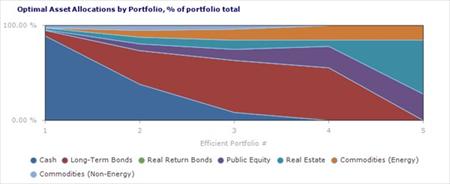

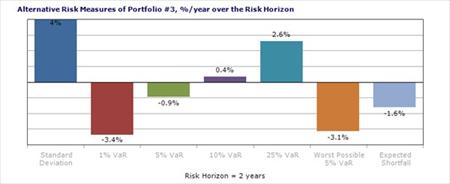

Sample Output Charts |

|

|

|

Text Area - product features and tour title

Text Area - product features and tour title

Page Menu - product sub menu

Page Menu - product sub menu

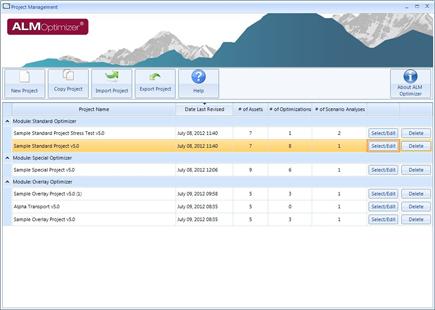

Image - First Input Image

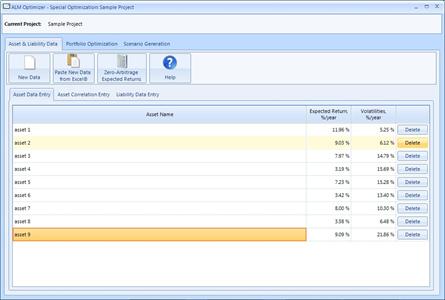

Image - First Input Image