Asset Allocation Software |

The ALM OptimizerProduct Features |

This software will facilitate your solutions to the following topics and questions.Overlay Optimization ModuleSimilar to the standard optimization module,

Hedging Investment Opportunity Set Shifts

Optimizing an Inefficient Core Portfolio

Alpha Considerations

Absolute Return Optimization

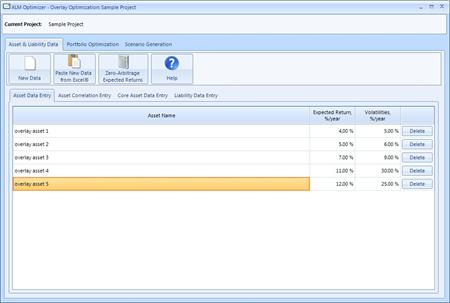

Inputs |

|

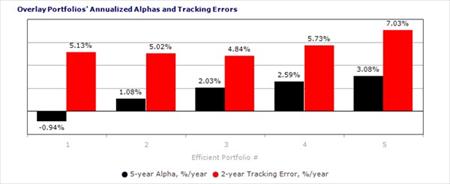

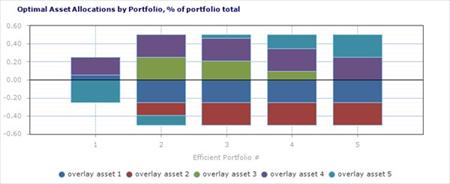

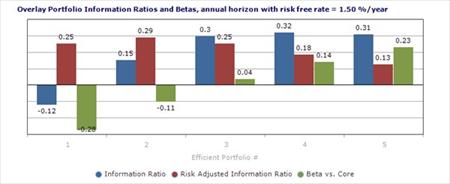

Sample Output Charts |

|

|

|

Text Area - product features and tour title

Text Area - product features and tour title

Page Menu - product sub menu

Page Menu - product sub menu

Image - Portfolio Optimization Parameters

Image - Portfolio Optimization Parameters