Asset Allocation Software |

All Asset Allocation Software is Not the Same!The ALMOptimizer® is an Asset-Liability-Model optimizer that offers significant advantages over other commercially available softwareview alm features |

|

What is Asset Allocation?

Asset Allocation is the specification of a portfolio’s optimal investment weights across financial asset classes. It is the foundation for portfolio construction and it is often used to benchmark actively managed portfolios. Consider the following:

Our ALMOptimizer® software is intended for portfolio managers who require easy to use, state of the art asset allocation tools.View ALMOptimizer® Advantages >> |

The Basics

|

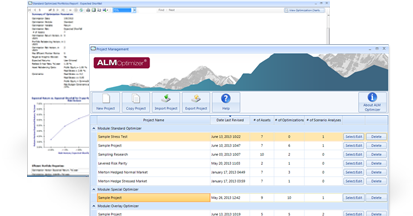

Our ALMOptimizer® software is a competitively priced, extremely user friendly, true global portfolio optimizer using lognormality on a .NET desk top platform. The search algorithm is by Frontline Systems Inc.® resulting in very fast and stable Asset Allocation solutions.ALMOptimizer® Features Five Integrated Modules |

Portfolio Optimization

|

Overlay Optimization

|

Scenario Generation

|

Special Optimizations

|

Currency Hedge Optimization

|

Image - ALM Optimizer Allocation Software

Image - ALM Optimizer Allocation Software

Text Area - What is Asset Allocation Title

Text Area - What is Asset Allocation Title